Services > Tax preparation & Refund advances

Tax preparation & Refund advances

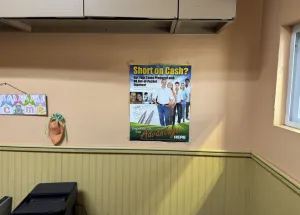

Tax refund advances are commonly available through tax preparation services like Tax Shield, allowing eligible taxpayers to receive a portion of their refund before it is officially processed by tax authorities.

This is especially beneficial for those who have immediate financial needs or want early access to their funds. However, repayment is required once the actual tax refund is issued.

Why Choose Taxshield service Ypsi?

There are several reasons why individuals might choose Tax Shield Services:

1. Comprehensive Services: Tax Shield Service offers a range of services, including Personal and Business Income tax filing, Holiday Advances, Shield Advances, Referrals, and Tax planning.

2. Experienced Tax Consultants: 12+ years of expertise suggests a high level of knowledge and proficiency in handling tax matters.

3. Specialization in Business Tax Preparation: The emphasis on specializing in business tax preparation and compliance indicates a focus on the unique needs of businesses

4. Consultations and Advice: The availability of consultations on complex tax-related matters underscores a commitment to customer service.

5. Audit Support: The assurance that Tax Shield Service is well-equipped to provide support in case of an audit adds an extra layer of security for clients.

6. Trustworthiness and Professionalism: The concluding statement instills trust by affirming that clients can trust Tax Shield Service with their tax matters, emphasizing diligence and professionalism in their approach.

Repayment of Tax preparation & Refund advances

The advance on taxes is designed to be repaid once the final tax refund is issued by the tax authorities. The repayment is often automatic, involving the deduction of the advance amount, along with the tax preparation service plus any associated fees directly from the taxpayer's refund.

It's very important to understand that the advance on taxpayer taxes is not synonymous with the actual the tax refund; instead, it depicts a portion of the total tax refund. Understanding this distinction is fundamental to managing expectations and making informed decisions.

Services > Tax preparation & Refund advances

Tax preparation & Refund advances

Tax refund advances are commonly available through tax preparation services like Tax Shield, allowing eligible taxpayers to receive a portion of their refund before it is officially processed by tax authorities.

This is especially beneficial for those who have immediate financial needs or want early access to their funds. However, repayment is required once the actual tax refund is issued.

Why Choose Taxshield service Ypsi

There are several reasons why individuals might choose Tax Shield Services:

1. Comprehensive Services: Tax Shield Service offers a range of services, including Personal and Business Income tax filing, Holiday Advances, Shield Advances, Referrals, and Tax planning.

2. Experienced Tax Consultants: 12+ years of expertise suggests a high level of knowledge and proficiency in handling tax matters.

3. Specialization in Business Tax Preparation: The emphasis on specializing in business tax preparation and compliance indicates a focus on the unique needs of businesses

4. Consultations and Advice: The availability of consultations on complex tax-related matters underscores a commitment to customer service.

5. Audit Support: The assurance that Tax Shield Service is well-equipped to provide support in case of an audit adds an extra layer of security for clients.

6. Trustworthiness and Professionalism: The concluding statement instills trust by affirming that clients can trust Tax Shield Service with their tax matters, emphasizing diligence and professionalism in their approach.

Repayment of Tax preparation & Refund advances

The advance on taxes is designed to be repaid once the final tax refund is issued by the tax authorities. The repayment is often automatic, involving the deduction of the advance amount, along with the tax preparation service plus any associated fees directly from the taxpayer's refund.

It's very important to understand that the advance on taxpayer taxes is not synonymous with the actual the tax refund; instead, it depicts a portion of the total tax refund. Understanding this distinction is fundamental to managing expectations and making informed decisions.

Recent Tax Advances

Recent Tax Advances

Our Process For

Tax preparation & Refund advances

Step 1

Bring in all your necessary documents; ID, SSN, Children birth certificate, proof of Child’s residency and their SSN, residency status, W-2/Pay Stubs, 1099s, receipts of expenses if self-employed.

Step 3

Schedule Your Taxshield service Ypsi Appointment

Schedule your appointment to one of our nearest locations near you or If you want to book your appointment in your desired date, You can schedule below.

Our Process For Tax preparation & Refund advances

Step 1

Bring in all your necessary documents; ID, SSN, Children birth certificate, proof of Child’s residency and their SSN, residency status, W-2/Pay Stubs, 1099s, receipts of expenses if self-employed.

Step 3

Schedule Your Tax preparation & Refund advances Appointment

Schedule your appointment to one of our nearest locations near you or If you want to book your appointment in your desired date, You can schedule below

Things to Know About

Tax preparation & Refund advances

Dive into the world of Tax Refund advances: Unveiling Holiday and Shield Advances:

Holiday Advances: These Advances are available during the holiday season, starting at an unspecified time and concluding on April 15. Eligibility criteria, such as income levels and filing status, apply, with a maximum advance capped at $500.

Shield Advances: These Advances open after the IRS begins accepting returns, catering primarily to W-2 filers. Exceptions may exist for self-employment clients, broadening eligibility. With a range from $500 to $7,500, Shield Advances accommodate diverse financial needs for individuals with varying income levels and circumstances.

Criteria for approval and eligibility: pivotal in determining access to financial services and benefits

Navigating the eligibility and approval process for these advances entails several factors, with specific requirements varying based on the taxpayer's documentation and information. Common considerations encompass crucial documents with NO credit check.The eligibility and approval process of these advances, often involves other factors, while specific requirements vary depending on the tax payer documents and information, here are common considerations.

Documents and Tax Return Information: Tax clients are required to furnish essential documents. This includes, W-2s/Pay-stubs, ID, birth certificate of dependents, Social Security Numbers (SSNs), proof of eligibility of dependents(living with Tax payer for at least six months).Tax preparers may request additional necessary documents to ensure accurate and comprehensive submission, fostering a thorough assessment of eligibility and facilitating the approval process for tax refund advances.

Repayment of funds borrowed in tax refund advances, crucial in managing financial obligations responsibly.

Tax refund advances are certainly short-term financial solutions, and are repaid when the whole tax refund is issued by the tax authorities. Understanding the repayment process of the advances is vital.

The advances and associated fees are deducted from the final tax refund. It's crucial for taxpayers to note that if the final refund is less than the advance amount, they bear the responsibility of repaying the full advance before receiving the ultimate tax refund. This awareness is very key in managing expectations throughout the whole process of the tax refund advances, emphasizing the need for careful consideration and planning when opting for such financial arrangements. Tax shield Services always recommends to plan accordingly in this due process.

Fees and associated costs in tax refund advances: considerations crucial for financial planning and decisions

Tax Shield service distinguishes its fee structure for different advances it provides. Holiday Advances come with no charges, offering a cost-free option, Again Tax Shield Service DOES NOT charge on the Holiday Advances. In contrast, the shield advance entail certain bank fees, depending on the advance amount.

To ensure transparency, tax preparers are obligated to disclose all relevant information to clients regarding specific fees and Shield advance fees before proceeding with the processing of their returns. This upfront disclosure not only empowers clients with comprehensive knowledge but also allows them to make informed decisions, considering the financial implications associated with each advance option and ensuring clarity in the overall tax preparation process.

Monday - Friday: 10:00 AM - 5:00 PM

Saturday: 11:00 AM - 5:00 PM

Sunday: Closed

Things to Know About Tax preparation & Refund advances

Dive into the world of Tax Refund advances: Unveiling Holiday and Shield Advances:

Holiday Advances:

These Advances are available during the holiday season, starting at an unspecified time and concluding on April 15. Eligibility criteria, such as income levels and filing status, apply, with a maximum advance capped at $500.

Shield Advances:

These Advances open after the IRS begins accepting returns, catering primarily to W-2 filers. Exceptions may exist for self-employment clients, broadening eligibility. With a range from $500 to $7,500, Shield Advances accommodate diverse financial needs for individuals with varying income levels and circumstances.

Criteria for approval and eligibility: pivotal in determining access to financial services and benefits

Navigating the eligibility and approval process for these advances entails several factors, with specific requirements varying based on the taxpayer's documentation and information. Common considerations encompass crucial documents with NO credit check.The eligibility and approval process of these advances, often involves other factors, while specific requirements vary depending on the tax payer documents and information, here are common considerations.

Documents and Tax Return Information: Tax clients are required to furnish essential documents. This includes, W-2s/Pay-stubs, ID, birth certificate of dependents, Social Security Numbers (SSNs), proof of eligibility of dependents(living with Tax payer for at least six months).Tax preparers may request additional necessary documents to ensure accurate and comprehensive submission, fostering a thorough assessment of eligibility and facilitating the approval process for tax refund advances.

Repayment of funds borrowed in tax refund advances, crucial in managing financial obligations responsibly.

Tax refund advances are certainly short-term financial solutions, and are repaid when the whole tax refund is issued by the tax authorities. Understanding the repayment process of the advances is vital.

The advances and associated fees are deducted from the final tax refund. It's crucial for taxpayers to note that if the final refund is less than the advance amount, they bear the responsibility of repaying the full advance before receiving the ultimate tax refund. This awareness is very key in managing expectations throughout the whole process of the tax refund advances, emphasizing the need for careful consideration and planning when opting for such financial arrangements. Tax shield Services always recommends to plan accordingly in this due process.

Fees and associated costs in tax refund advances: considerations crucial for financial planning and decisions

Tax Shield service distinguishes its fee structure for different advances it provides. Holiday Advances come with no charges, offering a cost-free option, Again Tax Shield Service DOES NOT charge on the Holiday Advances. In contrast, the shield advance entail certain bank fees, depending on the advance amount.

To ensure transparency, tax preparers are obligated to disclose all relevant information to clients regarding specific fees and Shield advance fees before proceeding with the processing of their returns. This upfront disclosure not only empowers clients with comprehensive knowledge but also allows them to make informed decisions, considering the financial implications associated with each advance option and ensuring clarity in the overall tax preparation process.

734-212-2438

Service Hours

Monday - Friday: 10:00 AM - 5:00 PM

Saturday: 11:00 AM - 5:00 PM

Sunday: Closed

Social Media