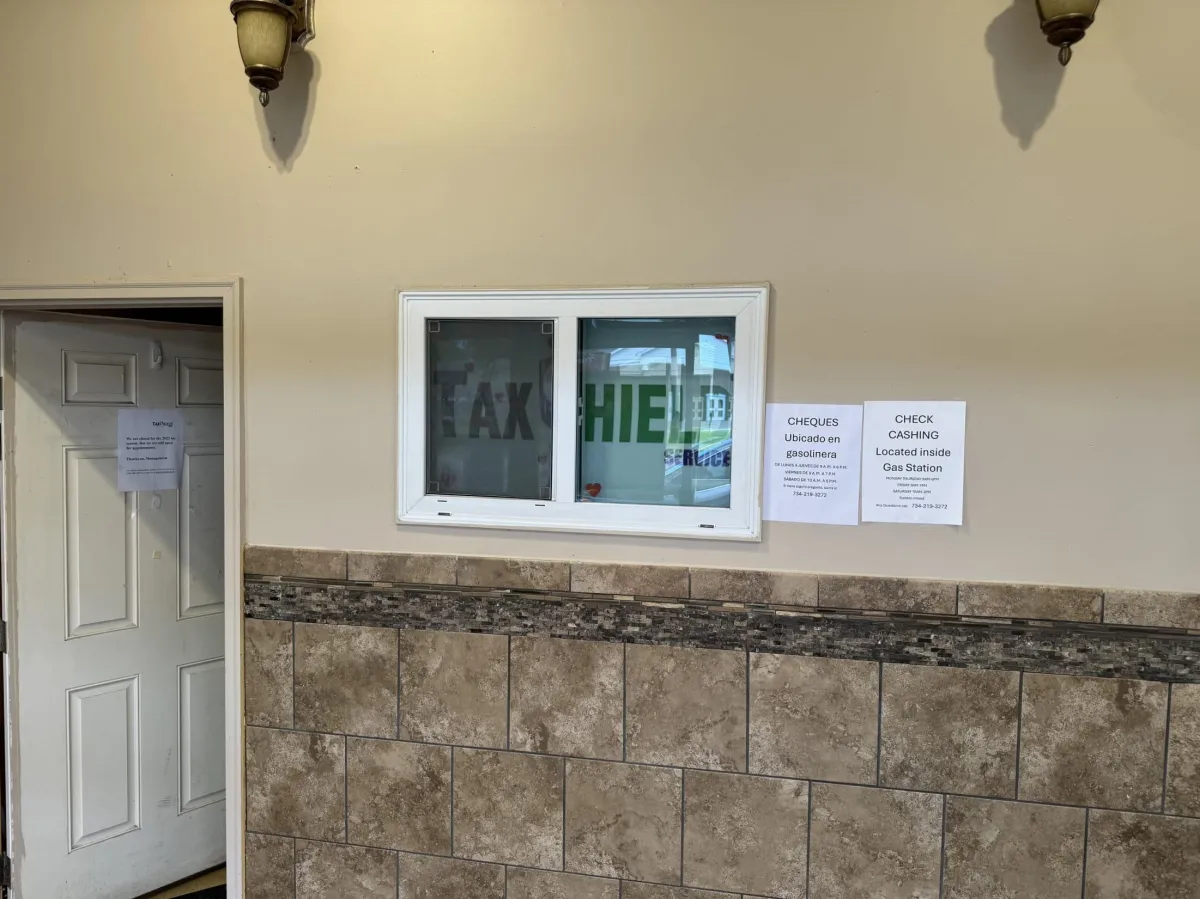

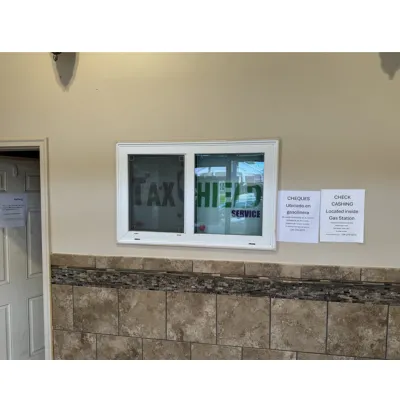

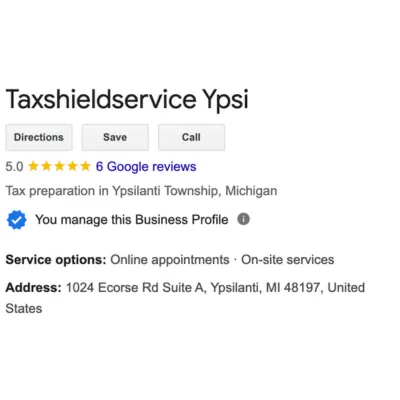

Best Tax preparation & Advances in Ypsilanti

Tax Shield Service offers expert Tax preparation and Refund advances, including Holiday and Shield Advances, Referrals, and Tax planning. Our seasoned tax consultants minimize tax liabilities and maximize savings. Specializing in business tax preparation and compliance.

With 12+ years of experience, we file taxes provide consultations and audit support, prioritizing integrity, accuracy, and client satisfaction. Trust us for diligent and professional handling of your tax matters.

What Is Tax preparation & Refund advances?

A refund advance on your taxes essentially allows tax clients to receive a portion of their refund when you file taxes and before the IRS accepts their returns. Tax Shield Services offers two types of Advances. The first is available within 30 minutes, accessible any time before the IRS begins accepting returns. The second is obtainable within 24 hours after the tax authorities or IRS has accepted the client's return.

These convenient options provide tax payers or clients with quick access to funds, catering to different timelines in the tax return process, ensuring flexibility and financial support during various stages of the tax preparation process.

What Is Referral program & Bonuses?

We take great pride in our referral program and the bonuses it offers, as they reflect the highest compliment we can receive from our community. As a token of our appreciation, when you refer a qualified new customer to TaxShield, you will receive a $50 check.

Additionally, our referral system offers further rewards: after you successfully refer five clients, you will earn $100 for each subsequent client referred, starting with your sixth referral. There is absolutely no limit to the potential rewards you can earn through our referral program. Thank you for helping us grow our community!

What Is Business tax & Audit support?

Tax shield Ypsi guarantees precise and compliant filings for businesses, addressing income, credits, and deductions. Our team of expert tax preparers simplifies the process, optimizing your financial standing.

In the event of an audit, our committed team offers robust audit support and comprehensive guidance, equipping both businesses and individual clients to effectively navigate the complexities and challenges associated with tax audits.

Best Tax preparation & Refund advances in Ypsilanti

Tax Shield Service offers expert Personal and Business Income tax filing, including Holiday and Shield Advances, Referrals, and Tax planning. Our seasoned tax consultants minimize tax liabilities and maximize savings. Specializing in business tax preparation and compliance.

With 12+ years of experience, we file taxes, provide consultations and audit support, prioritizing integrity, accuracy, and client satisfaction. Trust us for diligent and professional handling of your tax matters.

What Is Tax preparation & Refund advances?

A refund advance on your taxes essentially allows tax clients to receive a portion of their refund when you file taxes and before the IRS accepts their returns. Tax Shield Services offers two types of Advances. The first is available within 30 minutes, accessible any time before the IRS begins accepting returns. The second is obtainable within 24 hours after the tax authorities or IRS has accepted the client's return.

These convenient options provide tax payers or clients with quick access to funds, catering to different timelines in the tax return process, ensuring flexibility and financial support during various stages of the tax preparation process.

What Is Referral program & Bonuses?

We take great pride in our referral program and the bonuses it offers, as they reflect the highest compliment we can receive from our community. As a token of our appreciation, when you refer a qualified new customer to TaxShield, you will receive a $50 check.

Additionally, our referral system offers further rewards: after you successfully refer five clients, you will earn $100 for each subsequent client referred, starting with your sixth referral. There is absolutely no limit to the potential rewards you can earn through our referral program. Thank you for helping us grow our community!

What Is Business tax & Audit support?

Tax shield Ypsi guarantees precise and compliant filings for businesses, addressing income, credits, and deductions. Our team of expert tax preparers simplifies the process, optimizing your financial standing.

In the event of an audit, our committed team offers robust audit support and comprehensive guidance, equipping both businesses and individual clients to effectively navigate the complexities and challenges associated with tax audits.

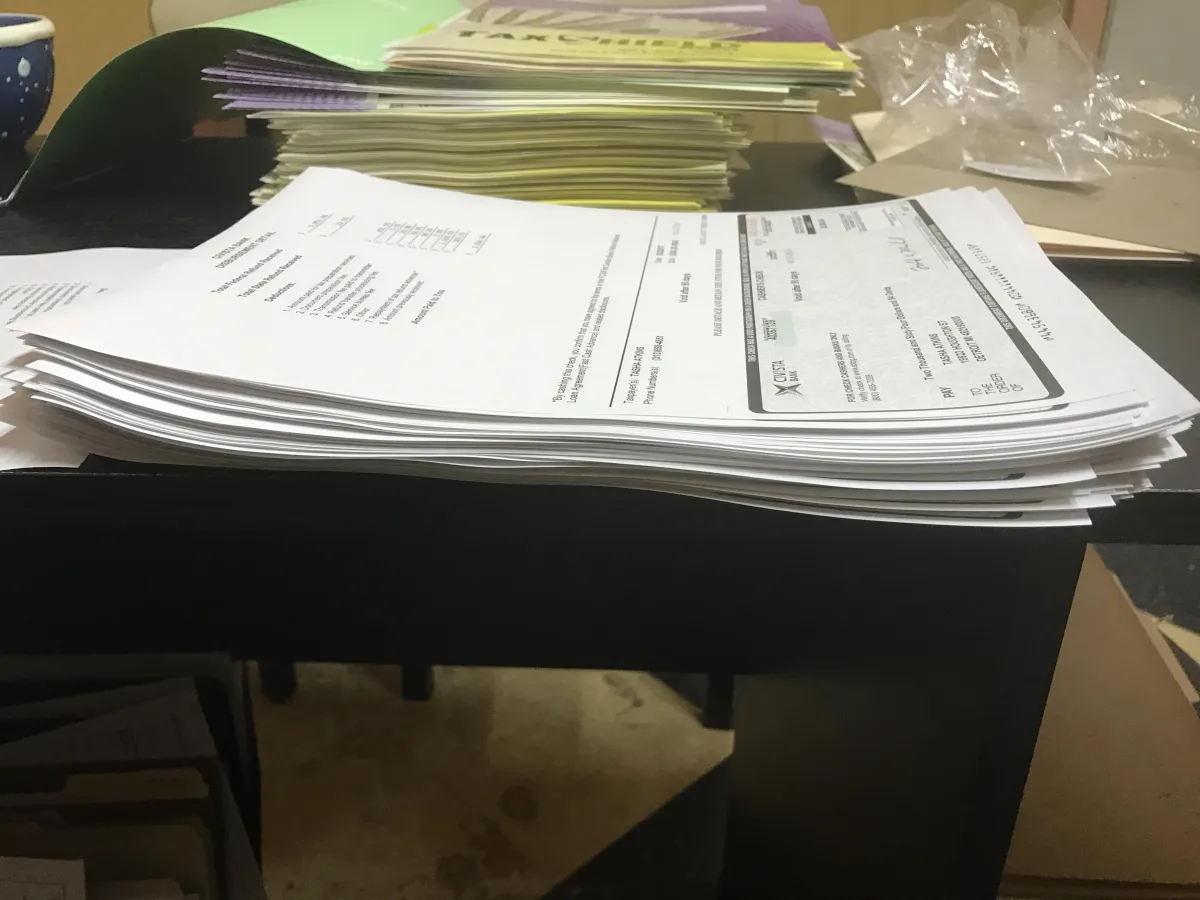

Recent Tax preparation & Refund advances

Recent Tax preparation & Refund advances

How It Works

Step 1

Bring in all your necessary documents; ID, SSN, Children birth certificate

and their SSN, W-2/Pay Stubs.

Step 2

Apply in one of our nearest location by brining the necessary documents to

the Tax Preparer.

How Tax preparation & Refund advances Works

Upon application and depending on the time line of the process, the tax preparer reviews the documents you gave them and evaluates your eligibility. Subsequently, you may receive a portion of your refund as an advance.

Repayment of the Advances

The process of repaying the advance usually occurs when the IRS issues the final tax refund. This repayment is often automated, with the tax preparation service deducting the advance amount along with any associated fees directly from the taxpayer's refund.

It's crucial to note that the advance on taxpayer taxes is distinct from the actual tax refund as you file taxes; it represents only a portion of the total refund. Understanding this distinction is essential to manage expectations, as the advance serves as a short-term pay against the anticipated refund.

Meet Your Team

Your Team

Taxshield service Ypsi Specializes In:

Other Services include:

Strategies to avoid tax evasion

Insurance premium evaluation for tax benefits

QuickBooks expertise for financial accuracy

Assistance with supplemental security income

Expense-related tax exemptions

Elaborating earned income tax credit

Explaining Adjusted Gross Income

Debt management plan

Santa Barbara Tax Products Group

Smart Investment

Tax preparer audit

Professional tax return filing

Tax return preparation and filing

Income tax return help

In person tax preparation

income tax return assistance

Corporate tax return preparation

Free tax filing assistance

Income tax specialist

Free tax filing help

Peace of mind with Audit support

Navigating through IRS Complexities with ease

Tax expert resolution of employment tax issues

Mobile app assistance for

ITIN Processing

Dispute resolution on taxes

Issues with Child tax credit

Navigating mobile app for taxes

Understanding fuel tax

formulario 1040 x

tax extension

consumer energy credit

Places to file my taxes

File company accounts and tax return

File company tax return

Irs free tax return

Free tax prep

Corporate tax prep

Tax planning services

Business tax filing services

Cash flow management

Tax strategies for diverse types of businesses

handling of poverty-related tax issues

Revenue optimization for Veterans

Handling dividend-related tax issues

issues with electronic funds transfer

debt consolidation referral

affordable care act

free file alliance

Helping mobile banking

Underwriting referral

Corporate tax preparation

Income tax return services

Financial services tax

Quick tax preparation

Tax preparation specialist

Tax service specialist

Local tax preparation services

Cheap tax preparation services

Free tax preparation low income

Tax specialists

Assistance of tax liens for disabled clients

Online tax filing

No credit check tax advance

Quick tax refund

understanding form 1040

Easy direct deposit set up

Free tax filing

Concept of S corporation

Wage and W-4 filing

Paycheck filing estimate

Fraud protection

Tax act

Gross income estimation

Mail taxes for free

Tax witholding understanding

Tax assistance

Business tax professional

Tax consultation

Back tax help

Business taxes

Tax preparation & Refund advances FAQ's

Q: What is a tax refund advance?

A: The tax refund advance is a great financial service that allows individuals to receive a partial amount of their anticipated tax refund before the complete refund is disbursed by tax authorities or the IRS. This process is distinct from receiving the entire tax refund, as the advance is a pre-issued portion facilitated by tax preparation services such as Tax Shield Services, offering a quicker resolution to financial requirements while awaiting the full refund from government authorities.

Q: How quickly can I receive a tax refund advance?

A: Taxpayers commonly prioritize the swiftness of the refund advance process. Holiday advances typically offer a rapid turnaround, often taking a maximum of 30 minutes, while Shield Advances are processed within 24-48 hours.

The eligibility for these quick advances is contingent on the client qualifying for a tax refund and having no outstanding debts with the IRS. This highlights the efficiency of these advances, providing timely financial relief for eligible clients who meet specific criteria and ensuring a prompt response to their financial needs while adhering to IRS regulations.

Q: What's the difference between a Holiday Advance and a Shield Advance?

A: Holiday Advances are issued during the holiday and end at April 15.

Depending on Tax Payer's eligibility, these advances range up to a maximum of $500.

Shield Advances are issued after the 1st day opening of IRS

accepting returns and only with W-2s with the exception of self-employments. These Advances range from a minimum of $500 and a maximum of $7,500.

Q: What happens if my tax refund is less than the advance amount?

A: This scenario contemplates a situation where the final tax refund falls short of the initially anticipated advance amount. Typically, taxpayers may not qualify for the Shield Advance under such circumstances. However, they still have the option to apply for smaller Holiday Advances, provided they meet the eligibility criteria.

This underscores the flexibility of the tax refund advance system, allowing individuals to navigate varying refund amounts and choose an advance option that suits their financial circumstances.

Q: What is the cost associated with a tax refund advance?

A: Tax Shield service distinguishes its fee structure for different advances. While Holiday Advances come with no charges, the Shield Advance involves specific bank fees. Tax preparers are committed to transparency, ensuring clients are fully informed about all associated fees and Shield Advance costs before processing their returns.

This upfront disclosure empowers clients to make informed decisions of each advance option and any related fees that may be incurred during the process.

Q: Can a taxpayer refuse to take advances if not interested with the amount?

A: Absolutely. Tax clients are fully empowered to choose not to take any advances and instead patiently await the entirety of their tax return. Tax preparers strictly adhere to this choice, respecting the client's decision-making autonomy. No checks or advances are issued without explicit consent, underscoring the importance of client consent and ensuring a client-centric approach in the tax preparation process.

This client-focused policy emphasizes transparency and the safeguarding of individual choices in managing their financial affairs and plan accordingly.

Monday - Friday: 10:00 AM - 5:00 PM

Saturday: 11:00 AM - 5:00 PM

Sunday: Closed

How It Works

Step 1

Bring in all your necessary documents; ID, SSN, Children birth certificate and their SSN, W-2/Pay Stubs.

Step 2

Apply in one of our nearest location by providing the necessary documents to the Tax Preparer.

How Tax preparation & Refund advances Works

Upon application and depending on the time line of the process, the tax preparer reviews the documents you gave them and evaluates your eligibility. Subsequently, you may receive a portion of your refund as an advance.

Repayment of the Advances

The process of repaying the advance usually occurs when the IRS issues the final tax refund. This repayment is often automated, with the tax preparation service deducting the advance amount along with any associated fees directly from the taxpayer's refund

It's crucial to note that the advance on taxpayer taxes is distinct from the actual tax refund as you file taxes; it represents only a portion of the total refund. Understanding this distinction is essential to manage expectations, as the advance serves as a short-term pay against the anticipated refund.

Meet Your Team

Team

Other Services Include:

Strategies to avoid tax evasion

Insurance premium evaluation for tax benefits

QuickBooks expertise for financial accuracy

Assistance with supplemental security income

Expense-related tax exemptions

Elaborating earned income tax credit

Explaining Adjusted Gross Income

debt management plan

santa barbara tax products group

Smart Investment

Tax preparer audit

Professional tax return filing

Tax return preparation and filing

Income tax return help

In person tax preparation

income tax return assistance

Corporate tax return preparation

Free tax filing assistance

Income tax specialist

Free tax filing help

Peace of mind with Audit support

Navigating through IRS Complexities with ease

Tax expert resolution of employment tax issues

Mobile app assistance for ITIN Processing

Dispute resolution on taxes

Issues with Child tax credit

Navigating mobile app for taxes

Understanding fuel tax

Formulario 1040 x

Tax extension

Consumer energy credit

Places to file my taxes

File company accounts and tax return

File company tax return

Irs free tax return

Free tax prep

Corporate tax prep

Tax planning services

Business tax filing services

Cash flow management

Tax strategies for diverse types of businesses

Handling of poverty-related tax issues

Revenue optimization for Veterans

Handling dividend-related tax issues

issues with electronic funds transfer

Debt consolidation referral

Affordable care act

free file alliance

Helping mobile banking

Underwriting referral

Corporate tax preparation

Income tax return services

Financial services tax

Quick tax preparation

Tax preparation specialist

Tax service specialist

Local tax preparation services

Cheap tax preparation services

Free tax preparation low income

Tax specialists

Assistance of tax liens for disabled clients

Online tax filing

No credit check tax advance

Quick tax refund

understanding form 1040

Easy direct deposit set up

Free tax filing

Concept of S corporation

Wage and W-4 filing

Paycheck filing estimate

Fraud protection

Tax act

Gross income estimation

Mail taxes for free

Tax witholding understanding

Tax assistance

Business tax professional

Tax consultation

Back tax help

Business taxes

Tax preparation & Refund advances FAQ's

Frequently Asked Questions

Q: : What is a tax refund advance?

A: The tax refund advance is a great financial service that allows individuals to receive a partial amount of their anticipated tax refund before the complete refund is disbursed by tax authorities or the IRS. This process is distinct from receiving the entire tax refund, as the advance is a pre-issued portion facilitated by tax preparation services such as Tax Shield Services, offering a quicker resolution to financial requirements while awaiting the full refund from government authorities.

Q: How quickly can I receive a tax refund advance?

A: Taxpayers commonly prioritize the swiftness of the refund advance process. Holiday advances typically offer a rapid turnaround, often taking a maximum of 30 minutes, while Shield Advances are processed within 24-48 hours.

The eligibility for these quick advances is contingent on the client qualifying for a tax refund and having no outstanding debts with the IRS. This highlights the efficiency of these advances, providing timely financial relief for eligible clients who meet specific criteria and ensuring a prompt response to their financial needs while adhering to IRS regulations.

Q: What's the difference between a Holiday Advance and a Shield Advance?

A: Holiday Advances are issued during the holiday and end at April 15. Depending on Tax Payer's eligibility, these advances range up to a maximum of $500.

Shield Advances are issued after the 1st day opening of IRS accepting returns and only with W-2s with the exception of self-employments. These Advances range from a minimum of $500 and a maximum of $7,500.

Q: What happens if my tax refund is less than the advance amount?

A: This scenario contemplates a situation where the final tax refund falls short of the initially anticipated advance amount. Typically, taxpayers may not qualify for the Shield Advance under such circumstances. However, they still have the option to apply for smaller Holiday Advances, provided they meet the eligibility criteria.

This underscores the flexibility of the tax refund advance system, allowing individuals to navigate varying refund amounts and choose an advance option that suits their financial circumstances.

Q: What is the cost associated with a tax refund advance?

A: Tax Shield service distinguishes its fee structure for different advances. While Holiday Advances come with no charges, the Shield Advance involves specific bank fees. Tax preparers are committed to transparency, ensuring clients are fully informed about all associated fees and Shield Advance costs before processing their returns.

This upfront disclosure empowers clients to make informed decisions of each advance option and any related fees that may be incurred during the process.

Q: : Can a taxpayer refuse to take advances if not interested with the amount?

A: Absolutely. Tax clients are fully empowered to choose not to take any advances and instead patiently await the entirety of their tax return. Tax preparers strictly adhere to this choice, respecting the client's decision-making autonomy. No checks or advances are issued without explicit consent, underscoring the importance of client consent and ensuring a client-centric approach in the tax preparation process.

This client-focused policy emphasizes transparency and the safeguarding of individual choices in managing their financial affairs and plan accordingly.

734-212-2438

Service Hours

Monday - Friday: 10:00 AM - 5:00 PM

Saturday: 11:00 AM - 5:00 PM

Sunday: Closed

Social Media

Explore Essential Tax Definitions: A Glossary for You

Common Tax terms explained ...more

informational

November 12, 2025•29 min read