How To Find The Right Business tax & Audit support

Understanding your business values and needs

As a small business owner, diving through the complex world of taxes can be overwhelming. Before navigating into finding the best business tax preparation and audit support, it's important to understand every business is unique and it’s better to assess the right place for your specific needs.

Navigating through various Business types and structures

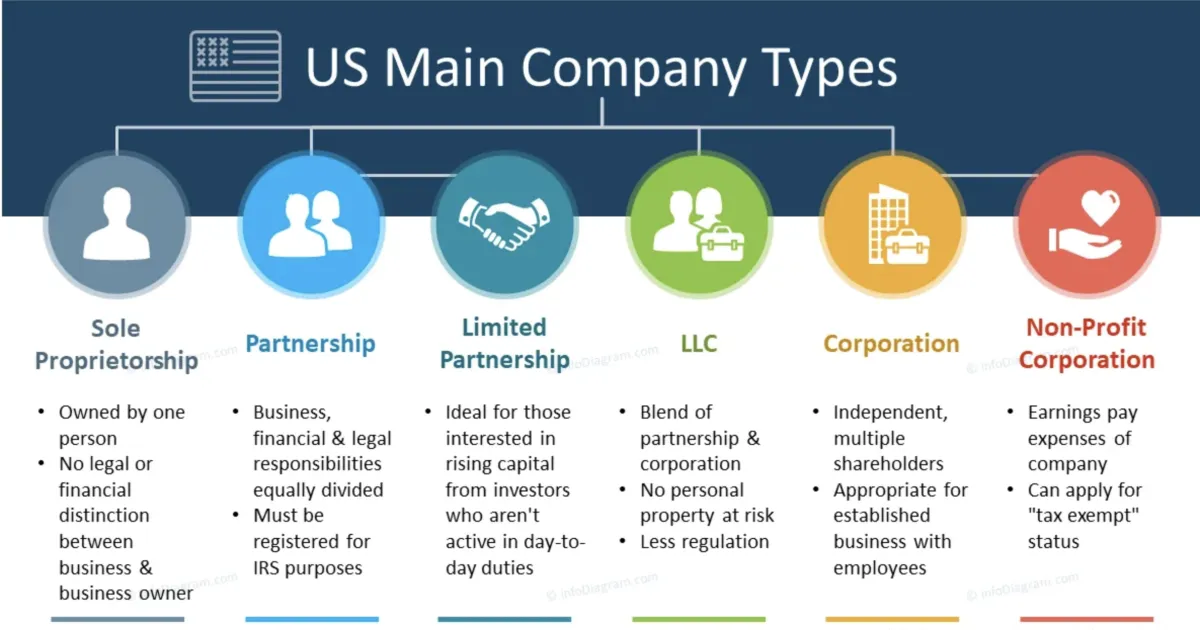

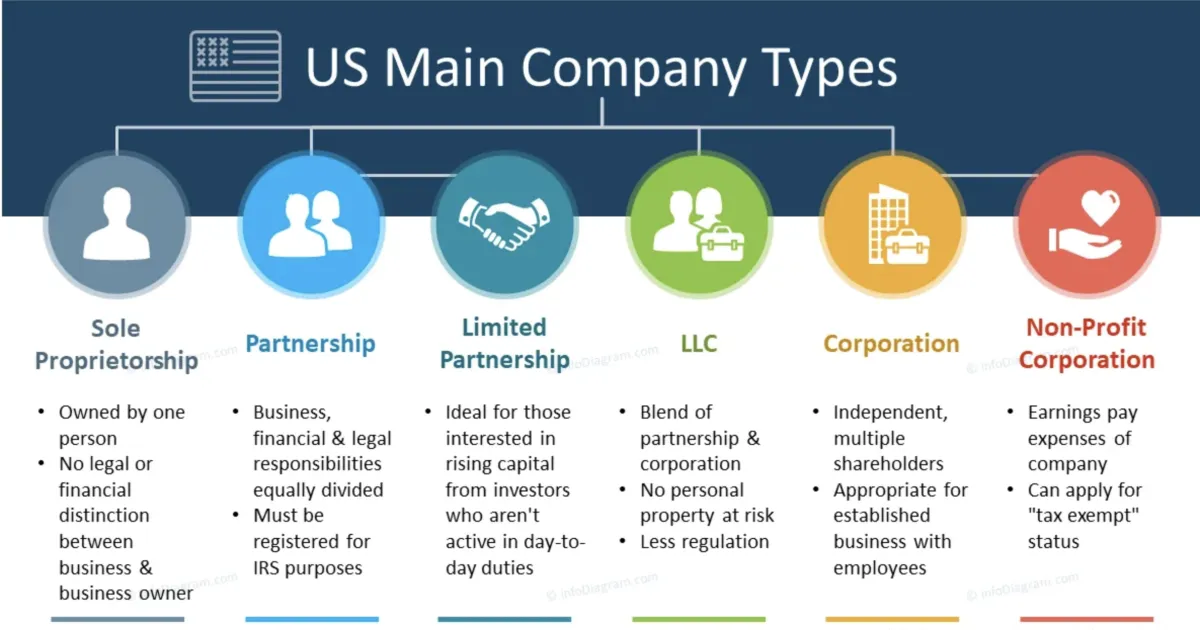

It is paramount for business tax clients to understand the distinct tax implications associated with different types of business structures (such as LLC, sole proprietorship, partnership, limited partnership, Non-profit organization and corporation). This helps business owners to optimize tax benefits and ensure proper compliance. The structure and type of your business play a momentous role in determining your tax obligations. Expert advice is invaluable in navigating the complex landscape of business tax preparation and minimizing the risk of oversights or errors. It is recommended for business owners to assess various tax places that understands the complexities of this business structures.

Different tax firms provide businesses promote financial health, strategic decision-making, and adherence to continuously evolving tax laws from tax authorities like the IRS. This allows taxpayers to tailor strategies and make business tax planning easier and faster. Take notes from tax locations on specific tax obligations that apply to your business and helps you strategize and maximize your deductions.

The key to business tax planning & organizing

Tax planning and organizing may feel like a tedious task, especially for small business owners and self-employed individuals. However, having enough educations and guidance on these concepts is vital for ensuring to minimize tax liabilities.

Utilizing simple softwares like Microsoft Excel and

other accounting tools are also beneficial to stream line record keepings. These tools can allow tax payers, especially self-employed individuals in generating reports for yearly income and expenses.

Business tax planning and organization is not just about meeting your legal requirements; it also opens the door to optimize your future planning. By organizing your tax planning and affairs, you can ensure compliance and maximize financial proficiency.

Well-designed organization is the benchmark of effective tax planning for self-employed individuals. This successful business tax planning includes; maintaining accurate records, hiring professional help and separating personal from business expenses avoiding red flags from tax authorities (IRS).

Self-employed individuals need to educate themselves and fathom unique tax obligations. Understanding the basics of self-employment taxes and deductible business expenses is paramount for tax planning and effective organization. Self-employment taxes includes Medicare and social security taxes. These taxes are mandatory for both W-2 and Self-employed individuals according to the tax authorities. Self-employed individuals are obligated for paying these taxes, unlike W-2 employees who share their costs with their employers and typically paying them bi-weekly.

One monumental advantage for self-employed individuals is their ability in deductions of business expenses such as home office expenses, supplies, travel that meets certain criteria. However, Business owners should maintain accurate records by making effective tax planning and organizing to avoid audit by the IRS.

Things to know about tax audit and audit support

Tax audit is often conducted by IRS agents via in person or in letter form to ensure self-employed individuals and tax payers are accurately filing and adhering to the tax laws. However, it could be stressful and intimidating process for tax individuals.

Audits are triggered by various factors. Usually, tax audits can occur randomly, but Self-employed individuals are more likely to be audited due to their complex financial situations, especially if they have discrepancies and inconsistencies in their reported income and expenses. Dealing with a tax audit can be overwhelming, which is why seeking audit support from tax professionals is essential. Tax experts who specialize on tax audit can guide you through the whole process and future tax planning and organization.

Remember to keep your records accurately and organize your tax planning. It is paramount to report your income to the best of your ability and armed with the right knowledge. By doing this, you will be well prepared to handle any tax audits.

Monday - Friday: 10:00 AM - 5:00 PM

Saturday: 11:00 AM - 5:00 PM

Sunday: Closed

How To Find The Right Business tax & Audit support

Understanding your business values and needs

As a small business owner, diving through the complex world of taxes can be overwhelming. Before navigating into finding the best business tax preparation and audit support, it's important to understand every business is unique and it’s better to assess the right place for your specific needs.

Navigating through various Business types and structures

It is paramount for business tax clients to understand the distinct tax implications associated with different types of business structures (such as LLC, sole proprietorship, partnership, limited partnership, Non-profit organization and corporation). This helps business owners to optimize tax benefits and ensure proper compliance. The structure and type of your business play a momentous role in determining your tax obligations. Expert advice is invaluable in navigating the complex landscape of business tax preparation and minimizing the risk of oversights or errors. It is recommended for business owners to assess various tax places that understands the complexities of this business structures.

The key to business tax planning & organizing

Tax planning and organizing may feel like a tedious task, especially for small business owners and self-employed individuals. However, having enough educations and guidance on these concepts is vital for ensuring to minimize tax liabilities.

Utilizing simple softwares like Microsoft Excel and

other accounting tools are also beneficial to stream line record keepings. These tools can allow tax payers, especially self-employed individuals in generating reports for yearly income and expenses.

Business tax planning and organization is not just about meeting your legal requirements; it also opens the door to optimize your future planning. By organizing your tax planning and affairs, you can ensure compliance and maximize financial proficiency.

The Tax & Legal Playbook: Game- Changing Solutions For Your Small- Business Questions 2nd Edition By: Mark J. Kohler. CPA, Attorney. Available on Amazon and EBAY

Well-designed organization is the benchmark of effective tax planning for self-employed individuals. This successful business tax planning includes; maintaining accurate records, hiring professional help and separating personal from business expenses avoiding red flags from tax authorities (IRS).

Self-employed individuals need to educate themselves and fathom unique tax obligations. Understanding the basics of self-employment taxes and deductible business expenses is paramount for tax planning and effective organization. Self-employment taxes includes Medicare and social security taxes. These taxes are mandatory for both W-2 and Self-employed individuals according to the tax authorities. Self-employed individuals are obligated for paying these taxes, unlike W-2 employees who share their costs with their employers and typically paying them bi-weekly.

One monumental advantage for self-employed individuals is their ability in deductions of business expenses such as home office expenses, supplies, travel that meets certain criteria. However, Business owners should maintain accurate records by making effective tax planning and organizing to avoid audit by the IRS.

Things to know about tax audit and audit support

Tax audit is often conducted by IRS agents via in person or in letter form to ensure self-employed individuals and tax payers are accurately filing and adhering to the tax laws. However, it could be stressful and intimidating process for tax individuals.

Audits are triggered by various factors. Usually, tax audits can occur randomly, but Self-employed individuals are more likely to be audited due to their complex financial situations, especially if they have discrepancies and inconsistencies in their reported income and expenses. Dealing with a tax audit can be overwhelming, which is why seeking audit support from tax professionals is essential. Tax experts who specialize on tax audit can guide you through the whole process and future tax planning and organization.

Remember to keep your records accurately and organize your tax planning. It is paramount to report your income to the best of your ability and armed with the right knowledge. By doing this, you will be well prepared to handle any tax audits.

734-212-2438

Service Hours

Monday - Friday: 10:00 AM - 5:00 PM

Saturday: 11:00 AM - 5:00 PM

Sunday: Closed

Social Media